P Pattabiramen & Co., has been assisting clients worldwide with their various tax obligations for more than 40 years. It has been at the forefront of corporate services’ to clients based across the globe.

With the introduction of Value Added Tax (VAT) in the UAE, our team of professionals has been focusing on clarifying and explaining our clients’ VAT obligations in the simplest way possible and then implementing and executing reliable procedures to ensure their VAT compliance.

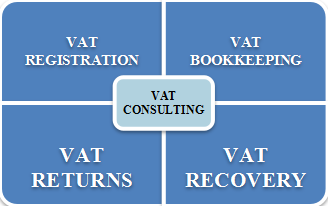

This strategy has enabled our clients to concentrate on their core business without being distracted by the imposition of this new tax on goods and services in the UAE. The range of VAT-related services that P Pattabiramen & Co can offer is as follows:

VAT Returns: VAT returns must be filed on a monthly or quarterly basis, depending upon the size of the business. There are specific deadlines for these returns and incremental penalties are applicable for default. These filings involve a declaration of standard-rated supplies, zero-rated supplies, exempt supplies, reverse charge transactions, imports and relevant taxes. A well-maintained accounting system and process is essential to produce the correct figures with ease at the right time. P.Pattabiramen & Co can assist clients with the correct and timely filing of VAT returns, and can also provide guidance with the process of settlement for amounts due. VAT Returns: VAT returns must be filed on a monthly or quarterly basis, depending upon the size of the business. There are specific deadlines for these returns and incremental penalties are applicable for default. These filings involve a declaration of standard-rated supplies, zero-rated supplies, exempt supplies, reverse charge transactions, imports and relevant taxes. A well-maintained accounting system and process is essential to produce the correct figures with ease at the right time. P.Pattabiramen & Co can assist clients with the correct and timely filing of VAT returns, and can also provide guidance with the process of settlement for amounts due.

VAT-compliant Bookkeeping: Many of our clients outsource their entire accounting function to P Pattabiramen & Co. We ensure that clients’ books of accounts are updated in a timely manner and all sales, purchases and expense transactions are recorded in full compliance with VAT regulations. We will also prepare the invoices and credit notes as per FTA-approved formats. It is essential to charge the correct VAT amount on each relevant supply and it is equally important to claim input VAT only on permitted transactions under the VAT legislation. Errors in this respect may attract unexpected penalties in future. Our bookkeeping service also includes the preparation of financial accounts on a monthly basis, which assists our clients to stay up-to-date with their business performance and financial position.

VAT Registration: The VAT law sets out mandatory and voluntary VAT registration thresholds. It is essential to determine which activities of the business are considered to be taxable supplies for VAT registration purposes. In some instances, it may be beneficial for certain businesses – typically start-ups with no sales and very high expenses – to register for VAT on a voluntary basis so that they can recover their input tax early. It is also important to ensure that a company gets registered for VAT within the specified deadline to avoid penalties for late registration.

The VAT registration process requires a number of documents to be submitted to the Federal Tax Authority (FTA). Uploading insufficient or incorrect documents can delay the approval process significantly. Our team has prepared a simple checklist of all such documents and can provide samples of the various formats required by the FTA. We only submit an application after we have thoroughly reviewed all the documentation. This will help to ensure a swift and straightforward VAT registration. VAT Registration: The VAT law sets out mandatory and voluntary VAT registration thresholds. It is essential to determine which activities of the business are considered to be taxable supplies for VAT registration purposes. In some instances, it may be beneficial for certain businesses – typically start-ups with no sales and very high expenses – to register for VAT on a voluntary basis so that they can recover their input tax early. It is also important to ensure that a company gets registered for VAT within the specified deadline to avoid penalties for late registration.

The VAT registration process requires a number of documents to be submitted to the Federal Tax Authority (FTA). Uploading insufficient or incorrect documents can delay the approval process significantly. Our team has prepared a simple checklist of all such documents and can provide samples of the various formats required by the FTA. We only submit an application after we have thoroughly reviewed all the documentation. This will help to ensure a swift and straightforward VAT registration.

VAT Consultation/Advisory: This is the most important aspect of our service. It gives us the opportunity to fully understand the day-to-day operations of a client’s business, the type and volume of supplies they make, their VAT inputs and outputs, the applicability of reduced rates and exemptions, and their record-keeping capacity. This enables us to assess how VAT applies to their business and identify the changes that are required to their existing accounting systems and business processes.

VAT Recovery: Businesses whose input VAT exceeds their output VAT for the period, are entitled to seek reimbursement from the FTA. The FTA may request an explanation or further supporting documents before processing the refund. P.Pattabiramen & Co can liaise with the FTA on behalf of clients on all tax related matters. P Pattabiramen & Co can respond to FTA queries, submit requests for reconsideration of FTA decisions and assist clients with any tax audits conducted by FTA. Where appropriate, P Pattabiramen & Co can also apply for de-registration of VAT on a client’s behalf. |